#1 - DeFi: Making the Shift from Traditional Finance to Decentralized Finance

An introduction to assets and securities decentralization via web3

Sections:

1. The problem with traditional banking

2. How DeFi fixes it

3. What's DeFi

The problem with traditional banking

In the world today, banks control the traditional financial system. They play vital roles in the distribution of money around the world—enabling monetary services (deposit, withdrawal, transfers), handing out loans, while also maintaining fiscal policies in the traditional financial market.

Banking institutions are so important that the cumulative market capitalization of the world's 10 largest banks exceeds $2 trillion.

However, the current banking and financial system is managed by human beings and regulated by fiscal policies vulnerable to human-related risks like mismanagement and corruption. In 2008, a global financial crisis caused a public outcry among banks because of excessive risk-taking, and many governments were forced to intervene by handing out massive bailouts for some of these banks.

DeFi aims to provide solutions to the pitfalls associated with the traditional financial market and develop a better financial protocol that's fully powered by blockchain technology, particularly in these three key aspects of the banking system:

- Payment and clearance system

- Accessibility

- Centralization and Transparency

1. Payment and clearance system

Anyone who's ever tried to receive or send money to someone in a foreign country knows the pain and rigor that accompanies these transactions. Commercial banks carry out transactions that take days to complete, in addition to the outrageous charges incurred, anti-money laundering laws, foreign exchange, privacy concerns, and other factors that slow down or stop the facilitation of these transactions. For example, if Mr Collins wants to send $1000 to his colleague in the US, he'll be required to pay at least three different fees: the exchange rates from his bank in Nigeria, the international wire outbound fee and the international inbound fee—and this transaction could take 2-5 working days to complete.

Banks also invest people’s money in stock markets as well as give loans at high-interest rates to earn profits, but the depositors do not see any of that profit.

DeFi provides a solution to this. It eliminates the need for an intermediary—who takes a larger chunk of the profits from these transfers—and also ensures the transactions are executed in the quickest time possible for a relatively meager fee compared to banks.

In contrast to banks, facilitating the transfer of large amounts of cryptocurrencies to any account in the world takes between 15 seconds to 5 minutes considering a few other factors and a small amount of gas fee.

2. Accessibility

For you to gain access to the financial services that banks offer, you’re required to have a bank account, but not everyone is fortunate enough to own or have access to a basic savings account because of low earnings.

According to a report by the World Bank in 2017, an estimated 1.7 billion people don’t have access to or own a bank account at any financial institution—most of them coming from developing nations like Nigeria, Central Africa and some parts of Asia. And these people mainly lack financial services because they lack income. However, DeFi platforms offer lending, trading, speculation, and various profit-making opportunities all based on digital tokens, smart contracts, and no regulated financial institutions. Learning how to use DeFi products creates a level playing field for everyone, making it easier to access wealth and financial solutions with the use of a mobile phone and internet access—without the lengthy verification procedures.

3. Centralization and Transparency

The centralization of power and funds by the banks in the traditional financial system poses a major threat to the global economy. As seen with the financial crisis of 2008, if a sector of the system fails to manage risk effectively, the entire market could crumble.

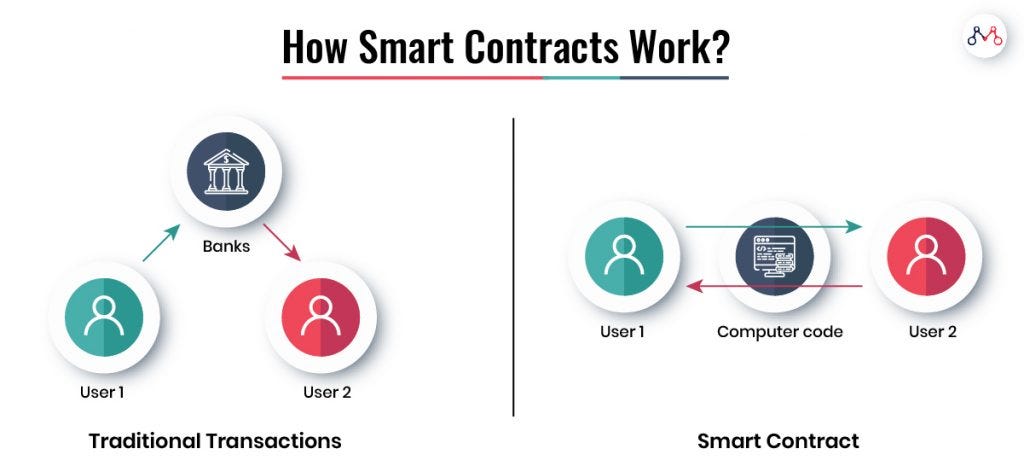

Transparency also plays a role in this as the current system gives little or no room for regular investors to audit the operations within a financial institution. With cryptocurrencies, every smart contract is built on a blockchain and each transaction block is stored in a public ledger, all easily retrievable and visible to all relevant parties.

DeFi applications and its protocols are built on public blockchains—such as Ethereum, Solana, Near, Fantom etc.—which make use of open-source models that can easily be audited by anyone within the network.

What's DeFi?

Decentralized Finance, popularly referred to as DeFi, refers to the movement that allows users to utilize financial services that include borrowing, lending, and trading without the need to rely on centralized entities – CoinGecko fundamental analysis

In simpler terms, DeFi applications are financial products that are built to run on a public blockchain such as Ethereum or Binance Smart chain which provides permissionless and automated financial services via the use of a smart contract.

DeFi is not a single company or a product but is a collection of products, and services that act as an alternative to financial institutions ranging from banking, insurance, bonds, and money markets.

Who owns DeFi?

Although DeFi applications first appeared on the Ethereum network developed by Vitalik Buterin, there's no single accredited inventor of DeFi. DeFi products have widely expanded over the years into other networks like Avalanche, Solana, and Metis (on ETH Layer 2) and they all automate payments with the use of smart contracts.

What are the key features of DeFi?

DeFi has several vital features that open up a myriad of possibilities and opportunities in the financial and technology industry.

These features include:

Open-source: you only need a wallet to gain access to applications—often without the need to submit or display any identification or sensitive information—which offers a simpler and easily accessible option as opposed to the banking system.

Speed and accuracy: you can easily transfer funds around the world almost instantly via the blockchain.

Lower rates per transaction: the current interest rates and fees are way cheaper compared to banks, although transaction costs vary depending on the blockchain network activity.

Composability: Financial products in DeFi work like legos. Anybody can easily create, modify, link, match or build on an existing DeFi product or blockchain without any permissions or restrictions.

Thanks for reading FacesofWeb3! If you didn’t understand parts of this article or need some stuff clarified, simply reply to this mail and we’d follow up with you! 💛

In the next article, we’ll explore the types of DeFi products and how everyone can use them.

Please share this newsletter, follow us on social media, and turn on your notifications to stay up to date with the latest information about NFTs and Web3!

Trivia⚡⚡⚡⚡

Test your knowledge

What makes DeFi a solution to traditional banking?

Tweet your response at us using the hashtag #TriviawithFOW3. We’ll send the person with the first correct answer a POAP (proof of attendance protocol, more on this later) and guide them through opening their first Web3 wallet!