ICYMI - Last week in crypto: Argentina into the Metaverse, DeGods dump Solana

Meanwhile, a new 77-second NFT record is set 🏆🚀

Last week, Defi giant Uniswap Labs announced an alliance with Moonpay to explore the traditional fiat market, and the Argentina Football Association partners with Upland to provide a metaverse experience for its fans. DeGods and y00ts announced their exit from Solana, Trump’s NFT collection tanks hard, and NBA Star-themed NFT collection SP33 sold out in 77 seconds.

Uniswap Labs Enters the Fiat Market With a Partnership with Moonpay

In order to allow users to buy cryptocurrency on its web app using debit cards, credit cards, and bank transfers, Uniswap has announced a partnership with fintech company Moonpay.

A major problem for decentralized exchange protocols that do not support fiat pairs is being addressed by the new service. However, centralized exchanges do.

Uniswap has enabled fiat-to-crypto conversions as part of the agreement on the Ethereum mainnet, Polygon, Optimism, and Artibrum.

According to the official announcement, the feature will initially support Dai, Ether, USDC, USDT, Wrapped Bitcoin (wBTC), and Wrapped Ether (wETH), but will vary depending on the region.

Major payment methods like cards and bank transfers are supported, but their availability will vary by region, according to Uniswap. The majority of the US, Brazil, SEPA, and the UK are the only countries that currently support bank transfers.

The new service, which aims to remove one of the main obstacles to DeFi adoption, boasts "no spread fees on USDC, lowest processing fees in the market, and instant access."

However, the precise details and schedule of the launch were kept under wraps.

The announcement from Uniswap coincides with a sharp increase in DEX user activity following the well-publicized collapse of the centralized cryptocurrency exchange, FTX.

In a recent report, Messari noted a rise in user migration to Uniswap. The platform's user activity increased as a result of the introduction of its NFT aggregator service.

The DEX leader drew criticism from some members of the community for its new privacy policy, which mandated the collection of limited off-chain data and public on-chain data, including device type and browser version, among other data, to improve user experience.

Argentina FA Partners with Upland to Explore the First Division of the Metaverse

Through a new strategic partnership announced last Tuesday, the Argentina Football Association will be able to connect fans to the teams and players they admire and give them a better understanding of how the metaverse functions and how they can contribute and profit from it.

With this partnership, Upland offers fans exclusive in-game video footage ownership for the first time and Argentinian football makes its metaverse debut.

The First Division Argentina (Professional Football League or short "LPF") will now be available in the Upland metaverse, according to an official license agreement signed by the Argentine Football Association (AFA), FIFA World Cup Qatar 2022™ World Champions, and Uplandme, Inc., the leading metaverse platform in mapping the real world with more than 3 million registered accounts.

Due to the extensive involvement of the global Argentine football community and the ability to connect users with their favorite teams and players, this strategic partnership will enable AFA and LPF to engage Argentinian fans with the metaverse.

In addition to uniting fans, collectors, and players from all over the world in a single virtual network, Upland offers users a variety of gamified interactions with a full range of iconic Argentine football digital collectibles, including teams, Clubs, Players, Tickets, Gameplay Footage, Historical Moments, Platform Exclusive Moments, and the Official Upland Market.

AFA and LPF will be able to connect users with their favorite teams and players thanks to this strategic partnership, which will enable Argentine fans to participate in the metaverse and make contributions to the online community.

Upland is an open metaverse platform that not only unites fans, collectors, and players from all over the world in a single virtual network, but also offers users a number of gamified opportunities to interact with a full range of iconic Argentine football digital collectibles, such as teams, clubs, players, tickets, gameplay footage, historical moments, platform exclusive moments, and the official Upland Market.

With this agreement, Argentine soccer will make its metaverse debut, and Upland will grant its fans exclusive ownership of in-game media for the first time. The user will purchase multiple assets of virtual goods licenses over the course of the next four years, providing the Argentine Professional Football League with a new revenue stream.

Argentine soccer fans will enjoy a distinctive metaverse experience thanks to this strategic alliance, taking advantage of a first-division football-focused social environment.

Fans can launch virtual businesses to resell LPF virtual goods and other digital collectibles in player-owned and operated shops situated on their virtual properties, including the 22 cities that are already open in Upland, which is a feature that is exclusive to that game world. Following the recently announced partnership with FIFA, where fans can access the highlights of the FIFA World CupTM, including the goals of the final as digital collectibles, Upland's agreement with the Argentine Football Association also broadens its involvement with international and European football.

Speaking about the partnership, the President of AFA - Claudio Fabian Tapia said:

“We are very happy to present this new commercial strategic agreement with Upland. The Argentine Professional League has long-awaited opportunities to take advantage of emerging technologies to enhance our League’s fan experience. This agreement allows us to partner with the best creators of technology and new digital products and thus generate a new source of income for all participating clubs. We welcome Upland as a new commercial partner of our Argentine Football Association and the Argentine Professional Football League.”

Also, Co-founder and Co-CEO of Upland, Dirk Lueth said:

“We are thrilled with the completely loaded licensing agreement and partnership with the AFA to continue to expand Upland’s footprint and community around the world. With AFA, we are able to offer more opportunities than ever before to Argentinian fans new and old, empowering them with the true meaning of web3, which is community-focused and entrepreneurial, allowing fans to contribute ideas and creations to showcase their team pride in engaging new ways.”

Leandro Petersen, Chief Commercial Marketing Officer of AFA, said:

“Upland is at the forefront of a new category of virtual NFT memorabilia. The platform uniquely combines digital collectibles uniting all global NFT markets into their own Metaverse. In this way, our Professional League will be able to get closer to football fans from all over the world and to the players who hope to be closer to the stars of our Argentine football teams every day. We are excited about the potential of this association and it is very important for us to continue generating new sources of income for AFA and the LPF. We continue with the expansion process started and develop digital products that increase the presence of Argentine Soccer in the world. With this agreement with Upland, we are achieving a great goal for the Argentine Professional Football League.”

dApp Industry Thrives Despite Crypto Winter: DappRadar

One of the harshest crypto winters in the market's history has been characterized by a steady decline in the value of digital assets, the collapse of major crypto firms, high-profile hacks and heists, and a sustained decline in the value of digital assets.

A recent report from blockchain data and analytics company DappRadar, however, raises the possibility that the industry may not be in such a dire situation given that it has displayed remarkable maturity and resilience throughout the crypto winter.

In spite of the bearish market conditions, usage of decentralized applications (dApps) has increased dramatically, according to DappRadar's 2022 Industry Report.

GameFi and NFT lead dApp Market Growth

The GameFi sector of blockchain gaming projects, in particular, had a significant impact on the dApp market this year. GameFi generated an average of 1.15 million dUAW per day and 7.4 billion transactions, accounting for 49% of all dApp activity.

The non-fungible token (NFT) market, which saw a 33% rise in daily dUAW and an increase of 876% in the number of unique NFT traders, also helped the dApp industry grow.

But even though the number of distinct NFT traders increased significantly, the volume of trading only went up by 0.41% over the previous year. NFT sales also increased significantly, jumping 10.6% to $68.35 million, though a different report claimed that almost 60% of this year's NFT trading volume was fake.

DeFi Shows Resilience despite TVL dropping by 73%

In 2022, the decentralized finance (DeFi) industry encountered difficulties and lost more than 73% of its total value locked. Despite this, the market's daily dUAW (decentralized Unique Active Wallets) increased by 2% to 652,970.

This might not seem important, but DappRadar points out that it is a remarkable accomplishment for the DeFi sector following the demise of Terra Luna, which at the time was the second-largest DeFi ecosystem.

The report ends by recognizing that the bear market has given the sector a chance to learn from mistakes and concentrate on developing sustainable projects while getting ready for the following bull season. Additionally, the industry's ability to grow despite difficult market conditions demonstrates its maturity and resilience.

Trump’s NFT tank after sellout launch

Donald Trump, a former president of the United States, launched his nonfungible token (NFT) collection with a sell-out launch that netted about $4.45 million from primary sales.

On December 16, Trump released his bizarre self-themed 45,000 NFT trading card collection for $99 each. Within a few hours of the NFTs' release, they were all snapped up, and over the course of the following two days, the floor price on OpenSea rocketed to an all-time high of roughly 0.83ETH, or $1,006.

Since then, though, the floor price has fluctuated, and some members of the community have called attention to the possibility that the NFT artwork has been lifted from other sources.

The floor price at the time of writing, according to OpenSea data, is 0.2 ETH ($242), representing a significant retracement of about 75%.

Additionally, trading volumes have drastically decreased, dropping from approximately 1,541 ETH ($1.8 million) on December 18 to just 14.37 ETH ($17,402) on December 21.

NBA Star’s NFT collection Sold out in 77 seconds

Last week, yet another well-known celebrity joined the NFT bandwagon. Scottie Pippen, a Chicago Bulls legend and NBA Hall of Famer, launched an NFT project that quickly sold out in just 77 seconds.

1,000 unique NFT metaverse-wearable sneakers from the "Scottie Pippen SP33" drop sold for a mint price of 0.2 ETH ($241) each. According to reports, "just about any ecosystem" is compatible with the Ethereum-based NFTs.

According to OpenSea data, the floor price has since increased to 0.42 ETH ($507), and the project has generated 211 ETH ($255,000) in trading volume since December 21.

A small number of randomly selected hodlers will also be given extra benefits, including 33 physical pairs of sneakers, two opportunities to play golf with Pippen, and one lucky individual who will be given a tour of Pippen's hometown and dinner afterwards.

The Web3 entertainment company Orange Comet, which also created a collection for Sir Anthony Hopkins that saw a seven-minute sellout, and appears to have a good handle on the format, collaborated on the creation of the SP33 NFTs.

“SP33 SOLD OUT IN 77 SECONDS

ORANGE COMET MAKES HISTORY ONCE AGAIN

Thank you all for participating in the @ScottiePippen SP33 Mint on @opensea.

Things only get better from here, stay tuned for more announcements on the utility reveal…” - Orange Comet announced in a tweet.

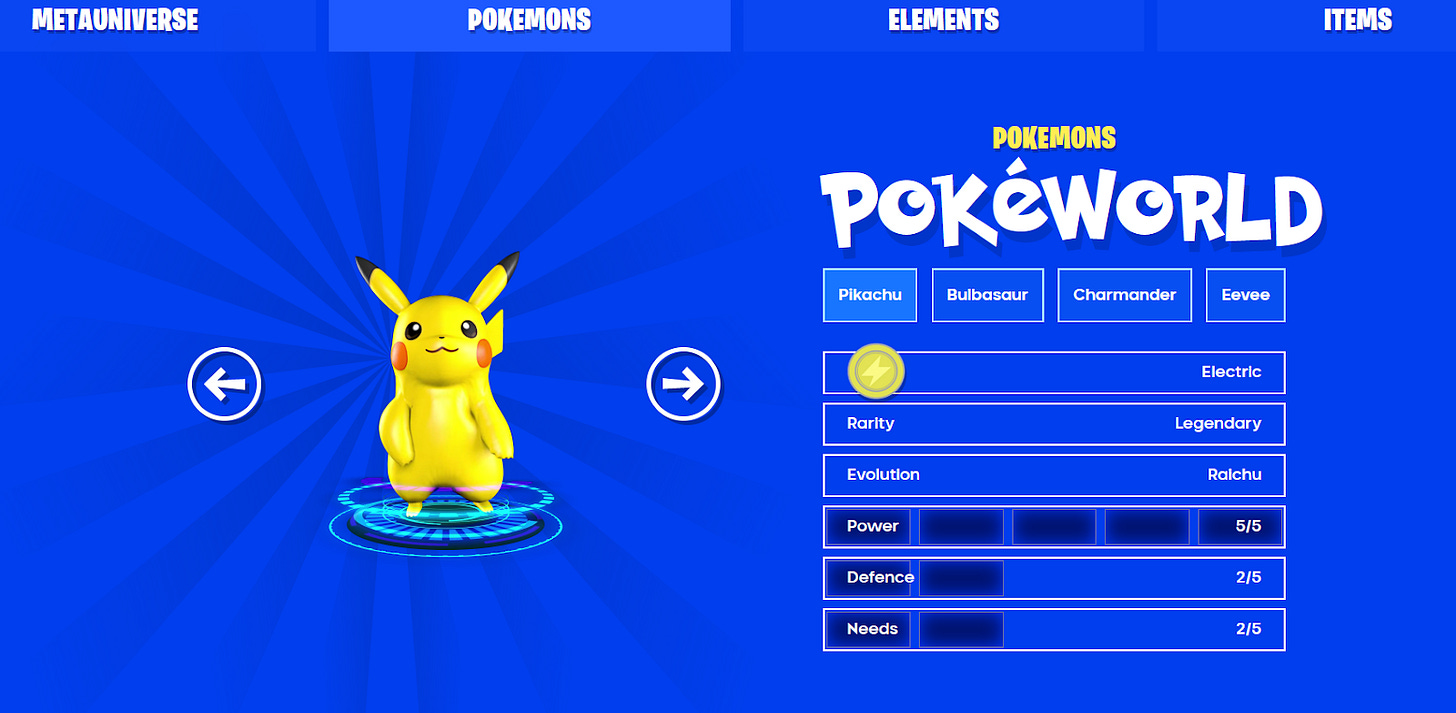

Pokemon drags NFT Company to Court

Documents filed with the Federal Court of Australia reveal that Pokémon Company International sued an Australian business for promoting an unauthorized NFT-based Pokémon game.

The company in question is known as "Pokémon Pty Ltd," and it has been promoting Pokeworld, an unofficial "metauniverse" P2E game, on Ethereum.

On its website, it also makes the claim that it has collaborated with Pokémon Company International on a number of official Pokemon games in the past.

The Pokemon IP owners are attempting to enjoin Pokémon Pty Ltd from claiming to have a license, a partnership, or other rights to sell Pokemon NFTs, according to court documents.

Additionally, it demanded the publisher stop promoting the game on its website and social media channels while using the Pokemon trademarks.

NFT Projects DeGods, y00ts to Leave Solana for Ethereum and Polygon

DeGods and y00ts have announced their departure from Solana and their move to Ethereum and Polygon, respectively.

According to their respective updates on Twitter, the top two NFT projects on Solana plan to switch chains in the first quarter of 2023. The duo said;

“The details of the bridge will be released when it’s ready & tested. This has never been done before at this scale. We want to make sure that it’s airtight.”

DeGods, an NFT profile-picture project, became a true titan across all NFT networks this year despite a rocky launch in late 2021. Its digital collectibles later developed into some of the most expensive ones on Solana.

DeGods purchased a team in the Ice Cube-founded professional basketball league BIG3, which plays in Los Angeles. It’s popularity grew, even more, this fall with the introduction of the eagerly anticipated y00ts project.

According to a recent report from Messari, Solana experienced over 19% growth in NFTs quarter over quarter and is now second only to Ethereum in terms of transaction volume and activity.

Because of the network's affordable gas prices and efficiency, NFT developers frequently chose it, which fueled the development of many lucrative projects on the platform.

The departures occur in the midst of a very bad year for Solana, particularly after being entangled in the drama surrounding the failed cryptocurrency exchange FTX, which caused its removal from the top ten on DeFiLlama's dashboard.

As a result, the total value locked (TVL) on Solana protocols decreased to $218.16 million. The skepticism was increased further by frequent network outages.