ICYMI - Last Week in Crypto: Ex-Coinbase Employee Insider Trading Scandal, Former employee Slams "Sloppy and Mismanaged" Celsius Network, Nigerian twitter user accused of rugpull and more

Its the battle of the exes 🥲

In the crypto space, last week could easily be termed "Ex-employees Week" after an ex-employee attacked the bankrupt Celsius Network and an ex-Coinbase employee was accused of insider trading. Meanwhile, on the NFT scene, Minecraft is prohibiting NFTs on the game for fear that they may lead to "Scarcity and Exclusion” and a Nigerian is linked to a massive rug.

Ex-Coinbase Employee Charged with Insider Trading of Crypto Assets

A former employee of Coinbase is being prosecuted for cryptocurrency insider trading.

Ishan Wahi, who was a product manager at the major exchange, was charged along with two other people.

They allegedly used confidential information about the coins that Coinbase was planning to list in order to make quick profit.

Wahi was alleged to have "detailed and advanced information" of when these listings will take place and is thought to have been involved in the "very confidential process" of choosing which cryptocurrencies would be added to Coinbase.

Prosecutors claim that between August 2021 and May 2022, he participated in a private message channel on Coinbase where this information was communicated.

At least 14 times, Wahi is accused of "misappropriating" this information and informing either his brother Nikhil or Sameer Ramani, a business partner.

Then, they allegedly made "profitable trades in certain crypto assets in anticipation of Coinbase's listing announcements," selling at a profit as the prices increased.

Overall, it's estimated that the men traded 25 different cryptocurrencies, and their combined profits were worth around $1.5 million.

Former Employee Takes Dig at "Sloppy and Mismanaged" Celsius Network

A former employee of Celsius Network has charged the business with "sloppiness and mismanagement."

Timothy Cradle, who formerly served as the company's director of compliance and financial crimes, claimed that Celsius was busy, disorganized, and chaotic.

He also made some rather severe claims against the troubled cryptocurrency lender in an interview with CoinDesk.

The value of CEL tokens was intentionally manipulated, according to charges made in separate lawsuits against Celsius executives.

Customers' withdrawals from the cryptocurrency lender were abruptly halted more than a month ago, and consumers are still awaiting word on when they will receive their cryptocurrency back.

Now that Celsius has filed for bankruptcy, it is clear that it has a $1.2 billion financial gap.

Cradle has questioned the viability of the company's plans to undergo restructuring and emerge from the ashes.

When withdrawals start again, he predicted that clients will swiftly empty their accounts and never come back:

"I think someone would have to be frankly insane to trust Celsius with their assets at this point." He added.

These companies, according to Coinbase, lacked adequate risk controls, and the problems are related to credit rather than cryptocurrency, adding:

"Many of these firms were overleveraged with short-term liabilities mismatched against longer duration illiquid assets … We believe these market participants were caught up in the frenzy of a crypto bull market and forgot the basics of risk management. Unhedged bets, huge investments in the Terra ecosystem, and massive leverage provided to and deployed by 3AC meant that risk was too high and too concentrated."

Michael Saylor Furious at TESLA For Selling 75% of its Bitcoin

Michael Saylor has slammed Tesla for selling 75% of its Bitcoin.

The CEO of MicroStrategy has long been one of the most upbeat voices in the cryptocurrency field.

His company now holds around 130,000 BTC and has pledged to "HODL through adversity," despite the fact that the value of this cryptocurrency has dropped by billions of dollars in recent months.

Saylor expressed his displeasure with Elon Musk's plan to free up liquidity for Tesla by selling its crypto investment, he tweeted:

"If you sell 75% of your Bitcoin, you will only have 25% of your Bitcoin left."

When it comes to collecting Bitcoin, MicroStrategy has taken a totally different approach than Tesla.

The business intelligence organization has aggressively taken on further debt in order to obtain even more cryptocurrencies.

This has caused MicroStrategy to sail close to the wind at times, and when Bitcoin plummeted under $21,000 earlier this year, the company was faced with a margin call on a $205 million loan from Silvergate Bank, which was backed by Bitcoin.

Minecraft Bans NFTs from Game over "Scarcity and Exclusion" Fears

Minecraft has announced that NFTs would be removed from the game.

According to the platform's amended standards, non-fungible tokens "may establish patterns of scarcity and exclusion that contradict with the essence of Minecraft."

Furthermore, the firm stated that the speculative nature of crypto collectibles "takes the attention away from playing the game and encourages profiteering, which we believe is inconsistent with our players' long-term delight and success."

For this reason, play-to-earn games have been extensively condemned, and some prominent corporations have faced backlash after declaring plans to embrace NFTs.

Minecraft has issued a warning that blockchain technology cannot be linked into its applications, and that NFTs related with in-game assets such as worlds and skins are not permitted.

However, the company says it will keep a careful eye on how the industry progresses and that it may reconsider if the technology becomes more secure, practical, and inclusive.

SeaRaiders NFT "Rugpull Project" Linked to Nigerian Tweep

A Nigerian Twitter user and NFT enthusiast has been linked to the infamous SeaRaiders NFT scam project. The accused on his Twitter account—@midePython—has disputed these claims and maintained his innocence citing he had no direct involvement with the project.

It all started off when a Twitter user, Gibbs355— (@infanova333) — started shilling the SeaRaiders NFT project to the community in early July. The SeaRaiders gained a lot of hype and gathered a lot of followings and engagements in very little time.

However, upon launch of the project, various Tweeps warned of a potential risk on the SeaRaiders mint page. Eventually, the SeaRaiders NFT was revealed to be a malicious attack on blue chip NFT holders.

The project's address was identified to have stolen 1 BAYC, 1 MAYC, 1 CoolCat, a Murakami, 1 Otherdeed and a Goblin NFT. Reports from @hiddeninWorld show that alongside @midePython, a few other people or aliases— @BiancaaLiima, @opetyy, @thecopy_guy, @NFTGod11820978— were also linked with the project.

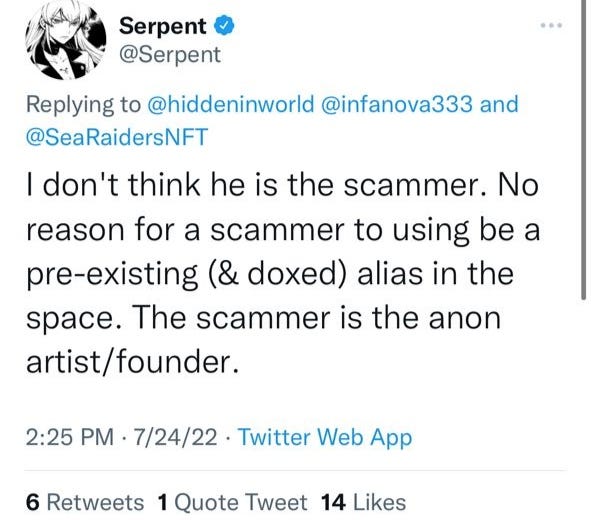

Furthermore, @hiddeninWorld disclosed in his tweet has he believes Gibbs355 was also a victim in the scam and had no involvement with its development.

Various tweeps shared their diverse opinions following the outrage from the victims and users who spent weeks on the hunt for a whitelist spot, only to be scammed of their money. Some believed @midePython could be innocent, however he has threatened to take up legal action to prove his innocence.

FOW3 found some reactions to the tweet:

In case you missed it, Heygrowth’s web3 summit starts today!

Listen to growth experts from around the world as they share the tips and tricks on how to expand your community and hit your goals in web3.

Use the promo code WEB3FACES to enjoy 10% OFF

See you next week!