Attacks on decentralized protocols continued last week as the Moola market was exploited for $8.4 million and 121 ETH was paid for gas fees by an Ethereum user. Warner Bros released NFT-exclusive films while trading volume began to fade on Opensea as other NFT marketplaces climbed up the pecking order.

$8.4 Million MOOved Out of the Moola Market

According to a number of sources, the DeFi lending platform Moola Market was exploited for $8.4 million on Tuesday.

Millions of dollars have been made from the exploitation of yet another DeFi protocol.

This time, Moola Market, a non-custodial liquidity protocol on Celo, is the victim protocol. Like other DeFi protocols, Moola enables users to take out over-collateralized loans, delegated loans, and flash loans, as well as earn compound interest on deposits.

Igor Igamberdiev, a researcher for The Block, first revealed the existence of the Moola exploit this afternoon by briefly describing the $8.4 million attack on the platform in a Twitter thread.

The exploiter bought 243,000 CELO from Binance and used those funds to attack Moola Market. In addition, they borrowed 1.8 million of Moola's native MOO tokens and lent Moola 60,000 CELO. The attacker eventually started pumping up the price of MOO by borrowing additional tokens while still holding the remaining CELO as collateral.

The hacker received 1.8 million MOO tokens ($655,000). Additionally, they acquired a number of stablecoins and tokens related to Celo, including 8.8 million CELO ($6.5 million), 765,000 cEUR ($750,000), and 644,000 cUSD ($639,000).

The attack has been addressed by Moola Market itself. The project paused all activity on its platform before posting a statement to Twitter stating that it is "actively investigating [the] incident." Also, it forbade users from trading mTokens, the interest-bearing tokens issued by Moola.

As part of its statement, Moola added that it had "contacted law enforcement and taken actions to make it difficult to liquidate the funds." If the funds were returned within 24 hours, it also promised to pay a bounty to the attacker.

The discovery of the incident comes soon after a $1 million theft via BNB Chain during an attack on the BitKeep wallet.

Other noteworthy attacks this month include one that cost TempleDAO $2.3 million, one that cost Mango Markets $100 million, and one that could cost BNB Chain $536 million. Some commentators will refer to October 2022 as "Hacktober" due to the alarming number of recent attacks.

Last week, the crypto analytics company Chainalysis claimed that 11 different attacks had resulted in the theft of about $718 million this month before the Moola market attack.

Angry Investor launches a Vigilante Hunt for Terra's Do Kwon

The most wanted fugitive in the cryptocurrency world is being sought after by at least one Terra investor who is trying to assemble a posse.

The Financial Times claims that at least one vigilante investor is searching for Do Kwon, the CEO of Terra. He hopes to garner as much support as possible as he calls for others to join in the hunt for the Terra founder.

Hunting Down Do Kwon

A cryptocurrency investor apparently made the decision to act independently in order to prosecute Do Kwon.

The Financial Times claims that certain members of the crypto club known as the "UST Restitution Group" are dedicated to discovering Kwon's whereabouts. And at least one of them—Kang Hyung-suk—has made it known that he plans to travel to the United Arab Emirates in order to track down Terra's' disgraced founder'.

Kang told the Financial Times, "I want to bring in more people to help with the hunt." In Dubai, there is a 50/50 probability of finding him.

When his creation, the Terra blockchain, saw its native stablecoin UST lose its peg and enter a death spiral in early May, Kwon—once regarded as a crypto prodigy—fell from grace. In just a few days, the crypto market lost more than $40 billion due to the collapse of the ecosystem.

Following the meltdown, South Korean officials declared they will look into Terraform Labs, Luna Guard Foundation, and Kwon as well. Kwon has so far refused to go back to South Korea and has actually becoming more evasive about where he is. He was previously identified as being in Singapore, but even that is uncertain. He appears to have left the nation sometime during the summer.

Due to Kwon's evasiveness, Interpol has issued a red alert for him, making him officially sought in 195 nations. Despite these circumstances, Kwon has repeatedly asserted in interviews and on Twitter that he is "not on the run" and that he is merely reluctant to reveal his location out of concern for his safety.

Following the collapse of the ecosystem, Terra investors established the UST Restitution Group, which has amassed around 4,400 members on its Discord server. To the FT, one of them reportedly added, "His days are numbered." We have some very, very close friends of Do Kwon.

Intriguingly, News sources were unable to locate any evidence of any such conversation taking place on the Discord server despite Financial Times' reporting that multiple "vigilantes" in the group were attempting to locate Kwon's whereabouts—the article mentioned Russia, Azerbaijan, Seychelles, or Mauritius as potential locations.

Suspected Ethereum Exploit Drains Wallet of 121 ETH in Gas Fees

Last Wednesday, a user of Ethereum spent $158,000 on gas fees for a transaction. On-chain analysts believe they were somehow exploited in a way.

An ongoing attack has allowed for the theft of more than $158,000 from an Ethereum user via a scheme involving astronomically high gas costs.

Blockchain security firm claims that user of Ethereum was tricked today into paying 121.56 ETH (about $158,000 at the time of writing) in gas fees for a transaction. The validator who handled the transaction then kept the fees for himself.

Circumstances surrounding the exploit and how it happened are yet unknown. MEV—which is the method of taking value from transactions by rearranging them while a block is still being constructed—looks to be connected in some manner to the attack, according to PeckShield. MEV-Boost relays on Ethereum let MEV strategists take advantage of these on-chain chances for arbitrage.

The most renowned company inside the MEV sector, Flashbots, completed the transaction using a MEV-Boost relay and a block-builder from builder0x69.

Meanwhile, the validator that delegated block production to the relay is connected to the liquid staking protocol Lido. However, at the time this article was written, it was unclear which of the parties—if any—was in charge of inflating the gas fee.

PeckShield's tweets indicate that the company believes the exploit was still active. The organization went on to say that 24 distinct addresses were "gaming for this type of rewards" shortly after posting about its discovery. PeckShield oddly stated later that none of the addresses were connected to Lido Finance, implying that the attackers might be employing a different validator than for the initial operation. A request for comment from PeckShield has not yet received a reply.

Warner Bros launches NFT-gated exclusive films

Following the announcement on October 20 that it had teamed with Web3 business Eluvio to establish its NFT-backed "WB Movieverse," the entertainment major Warner Bros is hoping to leverage NFTs to deliver exclusive content and movies.

The "movieverse" consists essentially of online access to Warner Bros.-owned movies as well as related, exclusive content like behind-the-scenes videos and photos. Users are authenticated using NFTs.

A 4K resolution extended edition of one of its Lord of the Rings titles with bonus content is the company's first entry into the movieverse. Two tiers of NFTs are required to access the bonus content.

According to the official secondary listings page, the sold-out higher tier of 999 NFTs was priced at $100 but now has an average listing price of $2,500 while the bottom tier of 10,000 NFTs is marketed at $30.

Warner Bros. had previously entered the NFT market by granting licenses to pop culture retailer Funko to sell NFTs that are unique to Walmart using characters from its DC Comics-owned IP.

Azuki NFT Scoops $2.5 Million in Record Breaking Skateboard Sales

The highest bid for a limited-edition 24-karat gold-plated skateboard made by the Azuki NFT project reached 309 Ether (ETH), or $400,000. This skateboard set a new record for the most expensive skateboard ever sold.

Through the sale of eight skateboards, the project earned $2.5 million in ETH, demonstrating the viability of its novel Physical Backed Token (PBT) system.

The previous record-holder, the almost $38,000 "Blowin' in the Wind Skateboard" made by skateboarder Jamie Thomas and including handwritten words by singer Bob Dylan, was substantially outbid by the highest bid.

The Physical Backed Token (PBT) technology standard was being used for the first time in this project.

PBT is a token standard—developed by the Azuki project—that scans a physical object with a mobile device to generate an NFT in the user's crypto wallet and uses a cryptographic chip to authenticate ownership of the item.

OpenSea’s dominance begins to fade

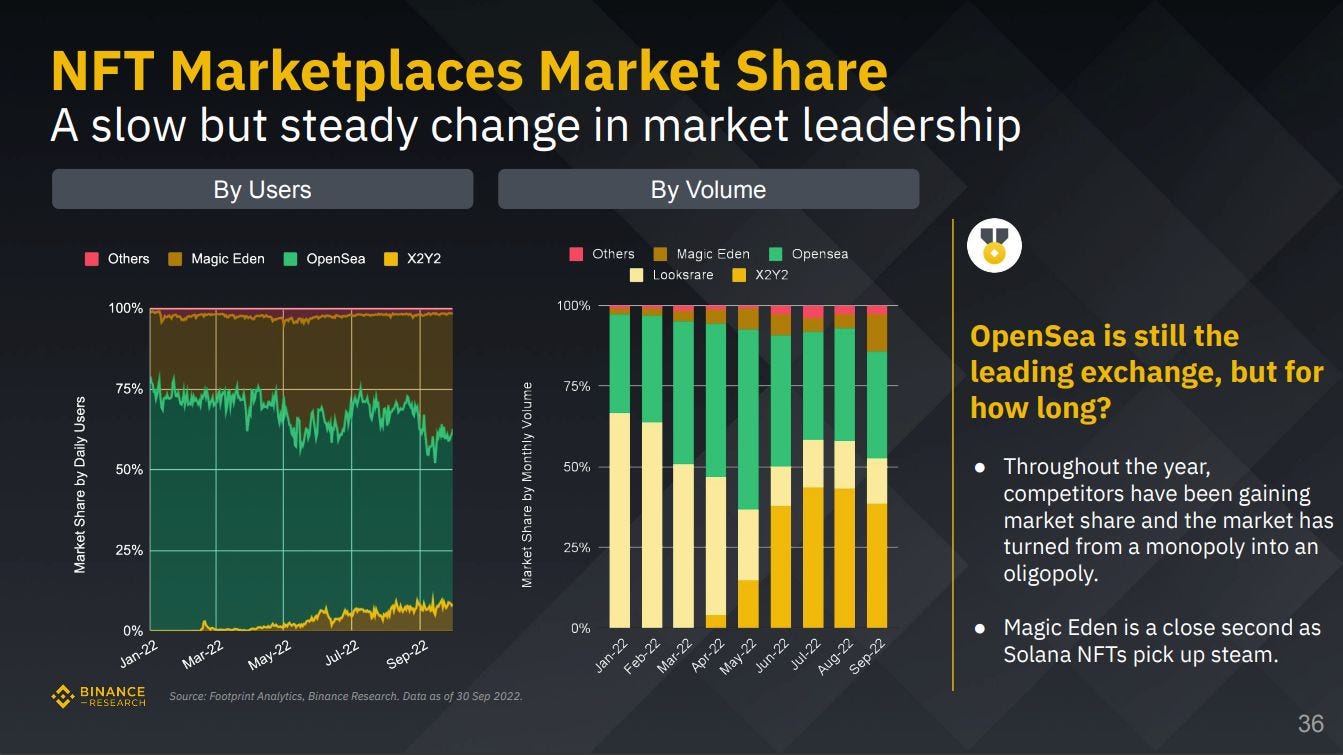

Following a new report, competitors in the nonfungible token (NFT) market place OpenSea have been chomping at its ankles this year as they increase market share, transforming the market from a "monopoly" into a "oligopoly."

According to the Oct. 20 release of the Binance Market Pulse, there has been a gradual shift in market leadership. While OpenSea continues to dominate the market in terms of users and volume, Ethereum-based exchanges X2Y2 and Looksrare have been gaining market share over 2022.

The report also noted that OpenSea is up against fierce competition in the Solana-based NFT market, with Magic Eden, its most popular native marketplace, coming in "close second" to the multichain OpenSea exchange.

OpenSea’s market dominance in terms of volume peaked in May 2022 but has seen a decline since. It comes amid what could be a major shift in NFT markets.

Following the Ethereum-based marketplace X2Y2's decision to implement optional royalties in August, the Solana-based NFT market Magic Eden made the same decision on October 14.

The "market has been shifting towards optional creator royalties for awhile," according to the statement.

At the end of the third quarter, Ethereum held 65% of the market share for NFT volume, according to Binance's Q3 report. However, NFT buyers may be switching blockchains in search of profits or to keep up with current trends.

Additionally, according to the data, Solana's NFT sales volume increased by 13% in Q3 while Ethereum's fell by 16% since the end of the second quarter.

Is great!!