Last Week in Web3: Coinbase announces new alliance, Meta snubs Europe on NFT Feature Rollout, Gucci now Accepts ApeCoin, and more.

Another day, Another WAGMI.

Last Week’s Crypto News recap highlights Coinbase's new partnership with BlackRock, and Meta's NFT feature rollout across 100 countries. Some positive news ahead for users of Voyager Digital as withdrawals are set to be open this week, however, Robinhood lets go of more staff due to financial turmoil. Lastly, Gucci adds Apecoin to the list of payment methods in selected stores across the United States.

Coinbase announces new partnership with BlackRock 🚨

A new collaboration between asset management company Black Rock and Coinbase has been revealed. The pair have joined forces to provide access to cryptocurrency for institutional investors.

Black Rock, being one of the largest asset management companies in the world, is only one of the reasons for this new relationship with Coinbase.

Following this new partnership, BlackRock clients who utilize the Aladdin investment management platform will have direct access to cryptocurrencies via a connection to Coinbase Prime, which offers trading and custody services.

Other digital assets might be included in the future, albeit initially just Bitcoin will be accessible. Joseph Chalom, global head of BlackRock's strategic ecosystem alliances, said:

"Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets."

Major Bitcoiners firmly believe that growing institutional adoption could increase demand for BTC as an asset and thus drive up prices.

Following the announcement, Bitcoin - the biggest cryptocurrency in the world - rallied in price to surpass $23,000 once more on Friday, reaching highs of $23,354.13.

Also, Coinbase's stock price received an even greater boost, rocketing to $106 on Thursday during intraday trade.

Over the last five days, the stock, which had struggled throughout the crypto collapse, has increased by 47%.

Voyager set to Re-open Withdrawals This Week

Voyager Digital has received court authority to allow its customers to withdraw money from FBO accounts held at Metropolitan Commercial Bank.

Despite going underwater, Voyager Digital has disclosed its plans to permit consumers to withdraw their money.

On July 1, the business originally put a halt to withdrawals and other trading activities. Then, on July 5, it submitted a bankruptcy petition, and shortly thereafter, court proceedings began.

Voyager now claims that its plan to give customers access to their assets has been approved by the court. According to an earlier disclosure, those funds are kept in a for benefit of (FBO) account at the Metropolitan Commercial Bank in New York.

“We know how important it is to access your cash, and with this approval, we will soon begin processing cash withdrawals,” the company wrote in its blog post on Friday.

From August 11, Voyager aims to restrict access to the Voyager app to cash withdrawals only.

Users of the site will be able to request ACH withdrawals of up to $100,000 USD every day.

Customers will receive an email with information on their holdings. If there are differences between the statement and their account, users have until October 3 to register a claim against the corporation.

According to Voyager, it attempts to fulfill requests "as swiftly as possible" and that users would get their funds in 5 to 10 business days. It states that all requests must go through a manual screening process that includes account reconciliation and fraud investigations. However, banks of users will also have an impact on the exact timeframe.

Additionally, Voyager affirmed that it is working on strategies to reorganize its business. In a statement today, it stated that it is "pursuing a solo restructuring process and a prospective sale of the company."

The court's approval of the corporate sale's bidding processes was also mentioned. A sale hearing will be held on September 8, and bids must be submitted by August 26.

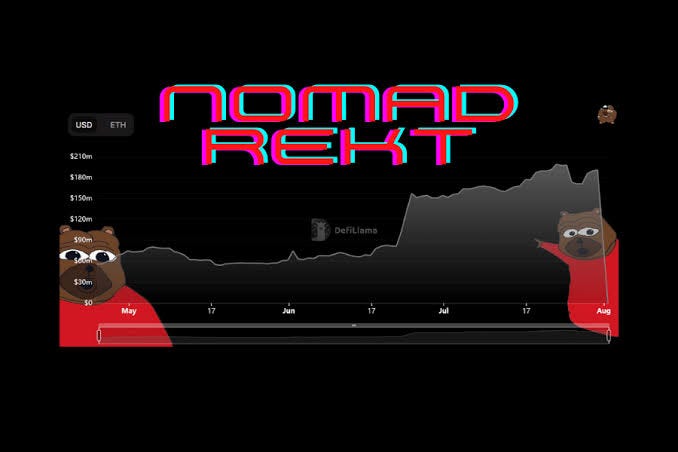

Nomad Bridge Place Bounty on White Hat Hackers After $190M Bridge Exploit

It's pretty much "another day, another hack" in the crypto space lately as questions are being raised about the security issues that accompany the use of digital assets. Last week, reports had it that a Solana chain exploit of around $60m was targeted at users of the Phantom wallets and the Nomad Bridge was also attacked.

In response to the devastating exploit that was discovered earlier last week, Nomad Bridge has stated that it will pay a 10% bounty to white hat hackers who recover monies that were taken.

An attack compared to a "free for all" saw the theft of an estimated $190 million.

White hat hackers won't be sued, according to the troubled cryptocurrency project.

Digital assets can now be transmitted to an official address, but Nomad is cautioning that "impersonators and other frauds" are on the rise.

Nomad further cautioned that it is collaborating with law enforcement organizations and blockchain analytics companies to guarantee the restoration of all funds.

So far, only 11.5 percent of the assets — around $22 million — that were stolen, according to the most recent Etherscan numbers, have been delivered to the designated recovery address.

According to data from Chainalysis, cross-bridge attacks have taken $2 billion so far this year, accounting for 69% of all crypto thefts.

Robinhood Axes 23% of Staff due to “Broad Crypto Market Crash”

Robinhood is cutting down on its workforce, again.

The stocks and cryptocurrency investment software provider has reduced another 23% of its employment after cutting staff by 9% earlier in the year.

CEO of Robinhood Vlad Tenev announced the company is further cutting its personnel by 23% in a blog post on Tuesday night. Tenev noted the unsettling macroeconomic environment as the reason for the choice, noting that it has had a significant impact on the cryptocurrency and stocks markets since the year's beginning.

"The macro situation has continued to deteriorate, with inflation reaching 40-year highs and a significant decline in the cryptocurrency market. This has further decreased customer trading activity and assets under custody," he added, stating that the company's operations, marketing, and program management departments saw the majority of the layoffs.

In an effort to decrease expenses and boost productivity, the company first let off 9 percent of its 3,800 employees in April. Robinhood is expected to have 2,662 staff left on its payroll following these most recent reductions.

Risk-on assets were destroyed in the first half of 2022 by soaring inflation and subsequent Federal Reserve interest rate increases. The low performance of high-growth tech companies and cryptocurrencies this year, which have historically seen the biggest trading volumes from Robinhood users, may be a factor in the app's deteriorating financial situation.

Tenev assured all impacted workers in his note that they will be given the option to continue working for Robinhood through October 1, 2022, earning their regular pay and benefits. Additionally, he stated that employees leaving the business would be given cash severance, payment of COBRA medical, dental, and vision insurance costs, and assistance with job searching.

Meta Rolling Out NFTs to 100 Countries Worldwide… But Not Europe

On the NFT scene, Meta has announced that it would expand NFT support to 100 nations worldwide.

Digital collectibles will be made available internationally in Africa, Asia, the Middle East, and the Americas.

However, it stands out that it appears that Europe has been left out of these plans, which may be a warning that continuous regulatory monitoring in the EU may be problematic.

Additionally, agreements have been reached with Coinbase and Dapper, enabling Instagram users to link their wallets.

In addition, Trust Wallet, Rainbow, and MetaMask are supported third-party wallets.

The three blockchains Ethereum, Polygon, and Flow currently enable NFTs, and Meta claims there are no fees for uploading or distributing a digital item.

This is a huge step toward making crypto collectibles widely accessible, and for many Instagram users, it's probably their first exposure to NFTs.

NFT capabilities were initially only available to a select group of American content creators thanks to Meta, which also controls Facebook and WhatsApp.

The social network explained in an announcement on Saturday:

"By building support for NFTs, we aim to improve accessibility, lower barriers to entry, and help make the NFT space more inclusive to all communities. It is also important that we keep Instagram a safe and enjoyable place for everyone. Therefore, people can use our tools to keep their accounts secure and report digital collectibles which go against our community guidelines."

Although the environmental impact of the blockchains that power NFTs has long been a subject of debate, Meta claims it intends to lessen this by investing in renewable energy.

Gucci Now Accepts Payments in ApeCoin

Gucci is doubling down on Web3 as reports emerged last week that the luxury brand now accepts ApeCoin as a payment method. As part of its ongoing exploration into the cryptocurrency market, Gucci added ApeCoin to its list of accepted cryptocurrencies on August 2.

The high-end fashion brand revealed on Twitter on Tuesday that some of its boutiques around the country have begun taking ApeCoin payments using BitPay. It follows Gucci's announcement at the beginning of May that it would accept cryptocurrency payments in a few of its stores in New York, Los Angeles, Miami, Atlanta, and Las Vegas. The list of accepted coins included Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dogecoin, Shiba Inu, and a number of stablecoins.

The Bored Ape Yacht Club-affiliated Otherside network of Yuga Labs launched ApeCoin as its governance and utility coin. During a market boom in 2021, Bored Ape Yacht Club rose to the top NFT collection in the world, and celebrities like Paris Hilton, Stephen Curry, and Jimmy Fallon have paraded it on television and social media. The ape-themed NFTs in the collection were initially produced for roughly $200 and are currently trading at a floor price of about 84 ETH, or about $135,000.

The addition of ApeCoin, according to Gucci, is "another milestone in the House's exploration of Web3," and it comes after a number of NFT-related initiatives, such as partnerships with 10KTF, SUPERPLASTIC, SuperRare and others have showcased it on television and social media.

Following closely on the heels of Gucci's announcement, Tiffany & Co.'s statement on Sunday cited that it would release a line of handcrafted pendants based on CryptoPunks, another renowned NFT line owned by Yuga Labs. Holders of CryptoPunk will be able to purchase a replica of their NFT for 30 ETH (approximately $48,600 at today's prices), and the replica will be made of "at least" 30 diamonds or gemstones. The piece will hang from a gold chain with additional diamonds on the clasp. A limited number of 250 "NFTiffs," NFTs redeemable for one of the pendants with a CryptoPunk motif, will be made available for the high-end brand's collection. Sales are poised to commence this Friday.

Have a great week!